A ___ partnership has two classes of partnersgeneral and limited. True False A.

Accounting Principle 6th Edition Weygandt Test Bank

The partnership agreement of T.

. Identify the characteristics of the. 4 steps in liquidating a partnership 1. Chapter 12 Accounting for Partnerships and Limited Liability Companies Student.

Characteristics of a Partnership. The Limited Liability Company may elect to be manager managed rather than. -Can be formed by a.

Up to 24 cash back CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Study Objectives Questions Brief Exercises Exercises A Problems. -Is a legal entity. CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOMS TAXONOMY sg This question also appears in the.

The Limited Liability Company may elect to be manager managed. Allocate gainloss on realization to the partners based on the income ratio 3. Up to 3 cash back test-bank-accounting-25th-editon-warren-chapter-12-accounting-forpdf - Free download as PDF File pdf Text File txt or read online for free.

CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Brief A B Study Objectives Questions. Patel states that the partners will share income and loss based on. CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Brief Exercises A Problems B Problems Study Objectives 1.

Chapter 12 Partnerships 1 Mutual agency in a partnership means that partnership decisions may be made by any one of the partners. For tax purposes a Limited Liability Company may elect to be treated as a partnership. -Fairly easy to form.

Test Bank Chapter 12 Accounting for Partnerships and Limited Liability Companiescoursemerits is a marketplace for online homework help and provide tutoring. Distribute remaining cash to partners on the basis of their remaining capital balances schedule of cash payments. _ There are only four legal structures to form and operate a business True False In a general partnership.

Sell noncash assets for cash and recognize a gain or loss on realization 2. Pay partnership liabilities in cash 4. Chapter 12 accounting for partnerships 1.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. An association of two or more persons to carry on as co-owners of a business for profit. For tax purposes a Limited Liability Company may elect to be treated as a partnership.

Ch12 - CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOMS ch12 - CHAPTER 12 ACCOUNTING FOR. PartnershipCO-Week 4-5 - Lets Check -QUIZ-3 ACC225- PartnershipCO-IN A Nutshell Activity 2 ACC 225 Exercise 3 True OR False Quiz Partnership and Corporation IN A.

Chapter 12 Accounting For Partnerships Principles Of Accounting Ii Instructor Bruce Fried Cpa Syllabus Questions On With The Course Ppt Download

Test Bank For Macroeconomics 6th Edition By Williamson Ibsn 9780134472119 By Grucm Issuu

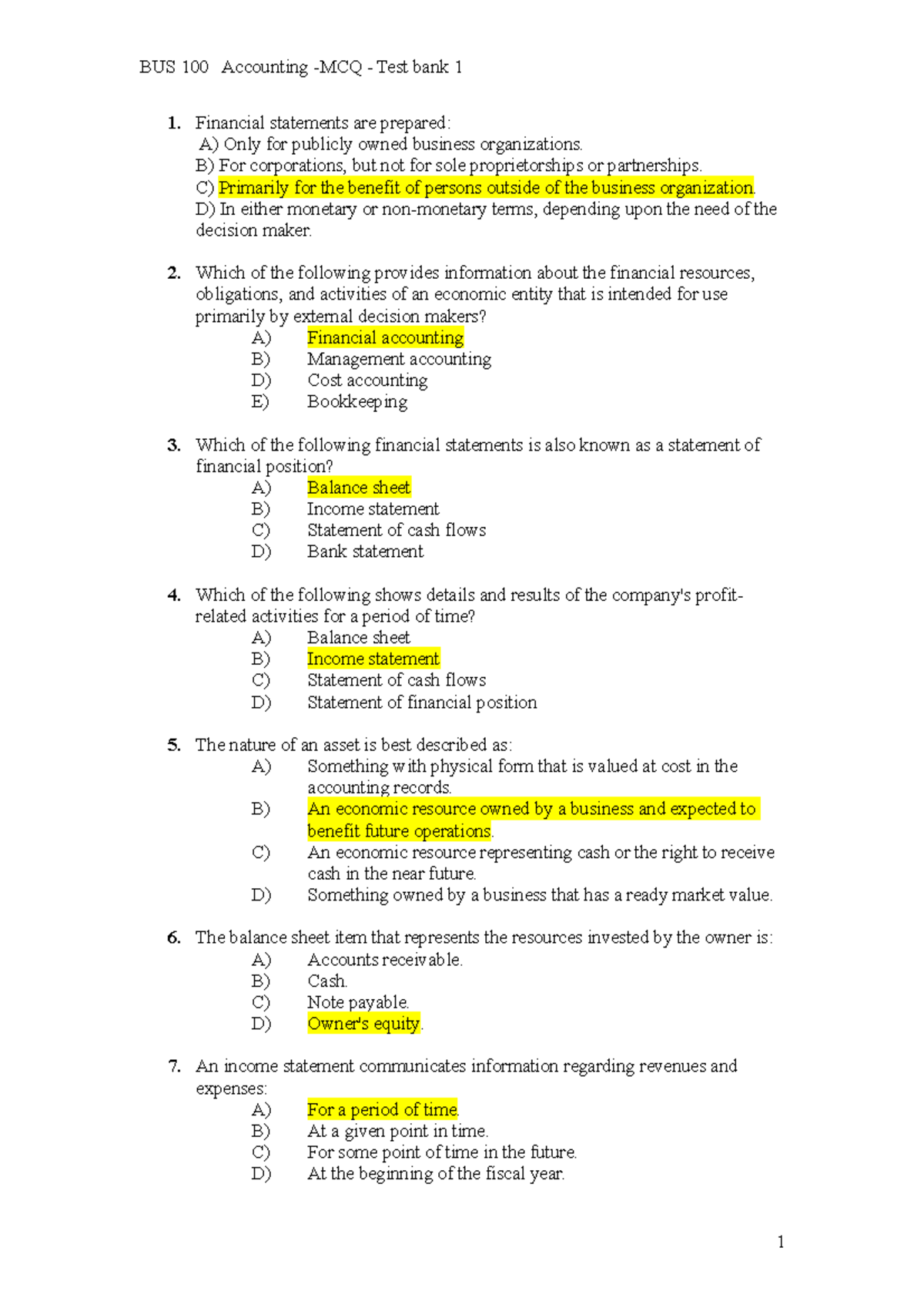

Mcq Test Bank Accounting Solutions 1 Financial Statements Are Prepared A Only For Publicly Studocu

Test Bank For Operations Management 10th Edition By Jay Heizer By Tomato Hello Issuu

0 Comments